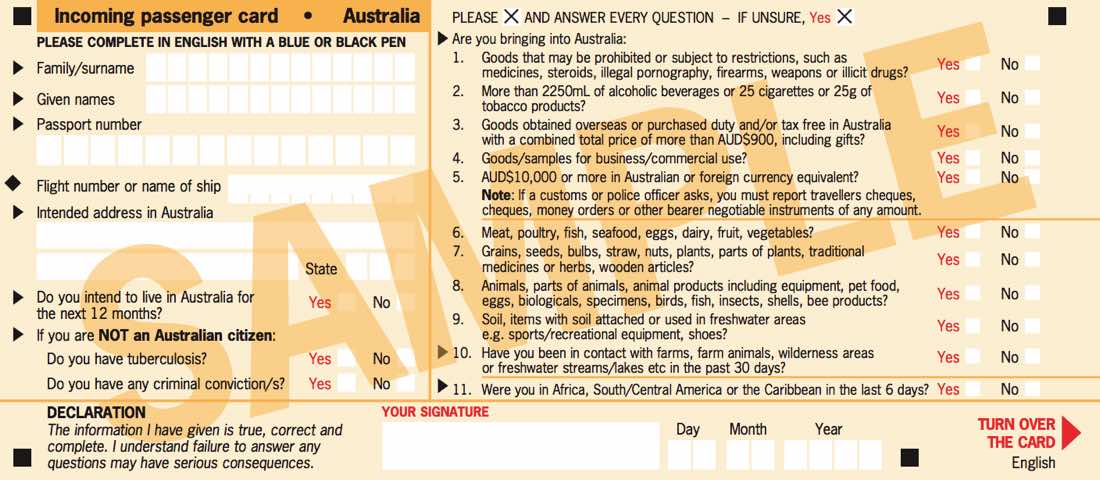

As an Aussie expat, there are plenty of things you need to consider. But one thing about expat life that is commonly disregarded or not given enough attention is the outgoing and incoming passenger cards.

We’re talking about that document that passengers fill out when they’re both leaving and entering Australia.

But why are they particularly important for expats?

As we’ve explained previously, one of the benefits of being an expat is that you can lose your Australian tax residency status and start reaping the full benefits of permanently living elsewhere.

If that sounds like your situation, then think very carefully as you’re filling out those passenger cards.

Why? Because the Australian Taxation Office is watching.

In the end, it’s the ATO that have the final say on whether you are an Australian resident for tax purposes – and if your passenger cards indicate that you haven’t really severed your ties with Australia, that could make a huge difference.

That’s right: any official records like passenger cards can be used against you. So while it’s not necessarily going to make or break your claim that you’re no longer an Australian tax resident, it is something to bear in mind. So read and fill in those cards very carefully, ensuring they properly reflect your situation. Always assume that authorities are reading and keeping these records and may use them if they challenge your tax status.

There are now plenty of documented cases in which Australian authorities have pulled out passenger cards to show discrepancies between what people claim for their tax but then declare as the reason for their travels.

So when you’re filling in those cards, know very clearly how they are used. In 2012, the Department of Immigration & Citizenship (DIAC) revealed that, once filled out, cards are sent to Canberra to be scanned and filed and are available for multiple agencies to use.

Also, it’s not just the obvious bits of the card that you need to consider – like the reason you’re travelling. In one case, an expat filled out his Australian address as a property he owned and where personal property was retained and that was a major factor for authorities to conclude that he was still a resident.

It’s cases like these that highlight how important it is to pay attention when you fill in those passenger cards during your travels into and out of Australia. If you’re not sure what to do, or you’re not sure if you’re really an Australian resident for tax purposes or what to put on your Australian tax return, Expat Tax Services can help. Get in touch with us today.

- Demystifying PFICs for Australians in the United States - 12/04/2024

- Update: Thailand Clarifies Tax on Foreign Income - 25/11/2023

- Remote Workers – Australia’s Opportunistic Tax Grab - 11/11/2023